Income Tax RPGT Stamp Duty and Petroleum Income Tax. 15 percent for disposals in the 5 th year after acquisition.

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

A tax audit is an event carried out by the IRB to ensure.

. Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases. Example of direct tax. Jan 19 2022 In 2020 the total amount of direct tax revenue in Malaysia amounted to around 11511 billion Malaysian ringgit a decrease from the previous year.

10 percent for disposals more than 5 years after acquisition. Direct taxes are collected by the Inland Revenue Board IRB and includes taxes such as income tax on individuals income tax on corporations petroleum income tax stamp duty and real. KUALA LUMPUR Aug 31 The direct and indirect tax collection stood at RM674 billion or 562 per cent of the target and RM248 billion or 59 per cent of the target respectively.

The Inland Revenue Board IRB is responsible for the overall administration of direct taxes in Malaysia at. As a developing nation the country heavily depends on FDI for its economic. Income tax is a direct tax regulated under Income Tax Act 1967.

Malaysia is generally receptive to FDI. This enables you to drop down a tax bracket lower your. There are no net wealthworth taxes in Malaysia.

Direct taxes lessen the savings of earners but indirect taxes encourage the opposite because. KUALA LUMPUR Jan 20. Income Tax Act 1967 ITA Other Malaysian non-Labuan entities deriving income from Malaysia are subject to tax under the ITA where the usual rate of tax applicable to companies is currently.

Inheritance estate and gift taxes. What is the outlook for foreign investment in Malaysia. The Malaysian Government targeted to collect an estimated.

Thats a difference of RM1055 in taxes. Direct Tax Income tax. TYPES OF TAXES IN MALAYSIA Direct taxes Paid directly by those on whom it is levied.

Direct taxes can help address inflation while indirect taxes can lead to inflation. I n Malaysia indirect taxes include import and export duties sales tax service tax excise duties tourism tax etc. A non-resident individual is taxed at a flat rate of.

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500. The Inland Revenue Board of Malaysia achieved a new record in direct tax collection last year with RM137035 billion collected which is 1113 or. The rate of both sales tax and service tax is 6.

Income Taxes in Malaysia For Non-Residents. You must pay taxes if you earn RM5000 or USD1250. 20 percent for disposals in the 4 th year after acquisition.

KUALA LUMPUR Aug 31 The direct and indirect tax collection stood at RM674 billion or 562 per cent of the target and RM248 billion or 59 per cent of the target respectively. You are regarded as a non-resident under Malaysian tax law if you stay in Malaysia. Taxpayers are required to submit their tax returns within the statutory deadline as legislated in the Income Tax Act 1967.

13 rows Malaysian ringgit.

7 Tips To File Malaysian Income Tax For Beginners

Business Income Tax Malaysia Deadlines For 2021

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

到底几时要报税 2017年income Tax 更改事项 很多事项已经不一样 这些东西也可以扣税啦 Rojaklah Income Tax The Cure Relief

7 Tips To File Malaysian Income Tax For Beginners

Business Income Tax Malaysia Deadlines For 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Individual Income Tax In Malaysia For Expatriates

Do I Still Need To Pay Tax If I Am Paying Pcb Every Month Tax Updates Budget Business News

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

How To Calculate Foreigner S Income Tax In China China Admissions

Business Income Tax Malaysia Deadlines For 2021

Cukai Pendapatan How To File Income Tax In Malaysia

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

How To Calculate Income Tax In Excel

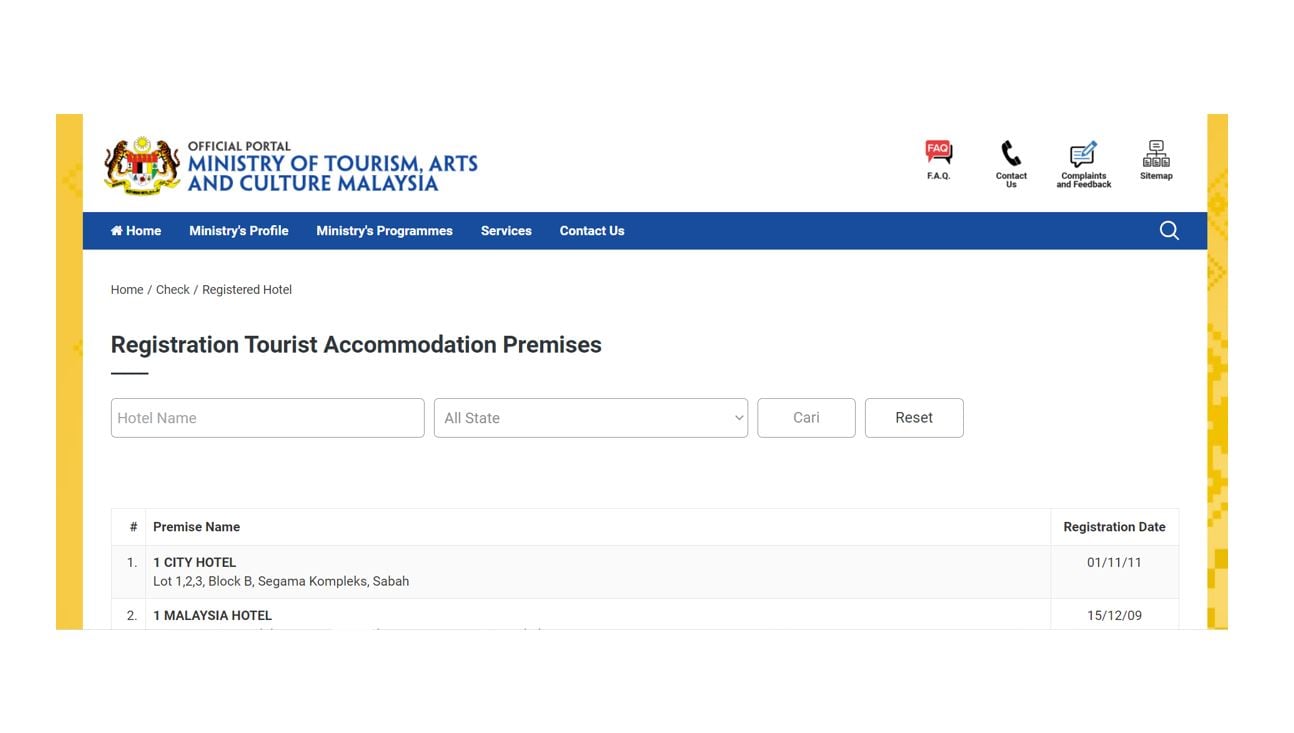

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief